EXECUTIVE SUMMARY

BlueCrow Capital x SC Hospitality present the opportunity to invest in their private equity fund focused on Portugal's booming luxury hospitality sector, whilst simultaneously securing your European Residency.

The Fund has currently secured investments in three prime hotel businesses in Lisbon, Porto and Douro Valley and has a pipeline of other attractive seed investments.

Managed by a team of experienced professionals, the Fund offers investors a secure, tax efficient and exciting path to European Citizenship.

Golden Visa Eligible

A Golden Visa (GV) Fund is the only practical investment route to apply for a GV.

Since Oct 2023 real estate investment has been removed as an eligible investment.

An investment of EUR 500,000 or more in this hospitality fund is fully eligible for Portugal's Golden Visa Application.

Prime Hospitality Projects

Investment, refurbishment, repositioning and expansion of existing hotels and heritage properties in prime locations into world class sustainable hotels and residences.

Short-listed operators include Rosewood, Mandarin Oriental, Marriott, Langham etc.

Highly Experienced Team

Combined US$ 1 bn Assets under management and 20 year Track Record.

The Management Team is highly experienced & fully regulated by the Portuguese Capital Market Regulator (‘CMVM’) providing a secure, professional and attractive Golden Visa investment.

Secure with Principal Guarantee, Flexible & Tax Efficient Investment Options

Your investment is secured against the hotels and hospitality businesses.

Providing a conservative 4% yield, principal guarantees and options for higher return. EURONEXT listing to provide rare and exciting liquidity opportunity. Extremely tax efficient structure for investors

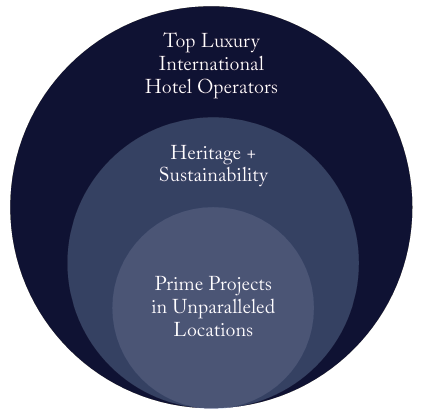

FUND STRATEGY

Sustainbility Oriented

All target projects will incorporate sustainability within their design, construction and operation.

Sustainable measures will be implemented to meet or exceed those required to comply with tightening EU measures over the next 5 years.

Niche Experiencial High-End Segment

All projects will be operated by top international hotel groups with ultra-luxury brands including Rosewood, Mandarin Oriental, Ritz Carlton or similar.

Hotels and Hospitality Focus

Fund strategy is designed to capitalise on the robust tourism market throughout the whole country and the growth driven by the demand from international visitors.

Hotels and Hospitality remain our investment focus. We will also consider other tourism and related investments.

Unique Properties in Unrepeatable Locations

All target projects are purposefully selected for uniqueness, sense of place and must be in strategic tourist locations to enable delivery of genuine and authentic experiences.

![]()

Heritage & Revitalisation

Heritage revitalisation contributes charm, and distinct sense of place to all our projects with each property telling its own authentic story.

Restoration of existing buildings also helps reduce waste and carbon footprint of the project.

GOLDEN VISA ELIGIBLE

As of October 7th 2023, Law 56/2023 introduced notable changes to Portugal's Golden Visa program, including the cessation of the real estate investment option and capital transfer option. Furthermore, adjustments were made to the criteria governing qualifying investment funds. Details of the eligibility of our funds is as follows:

|

Conditions For GV Eligible Fund

|

|

Unrelated to Real Estate Sector

|

|

The fund needs to be regulated by CMVM

|

|

Long Term Investment Horizon > 5 years

|

|

Portugal Investment Focus

|

|

Amount equal or greater than EUR 500,000

|

|

Details Of Our Investment Opportunity

|

|

Investors will subscribe to shares / units of the hospitality fund. All the fund's investments will be dedicated to the development and expansion of the hospitality business i.e. payment for construction service, payment to development consultants, hiring of hotel operational staff, long-term rental payment for the use of properties etc.

|

|

BlueCrow Capital (License No: 138537) is appointed as the fund manager. The Fund is registered as BlueCrow Development Fund I – Sub Fundo B under license No: 1814-0002.

|

|

Our Fund's maturity exceeds 8 years with early exit option by year 6 when the investor attains the passport.

|

|

To qualify as a Golden Visa eligible fund, the fund must allocate over 60% of its investments in Portugal. Our fund is primarily targeted to invest in 3 Portugal projects.

|

|

Our minimum investment amount is EUR 500,000.

|

SIMPLE, STRAIGHTFORWARD & HASSLE-free SUBSCRIPTION & APPLICATION